All Categories

Featured

Table of Contents

[/image][=video]

[/video]

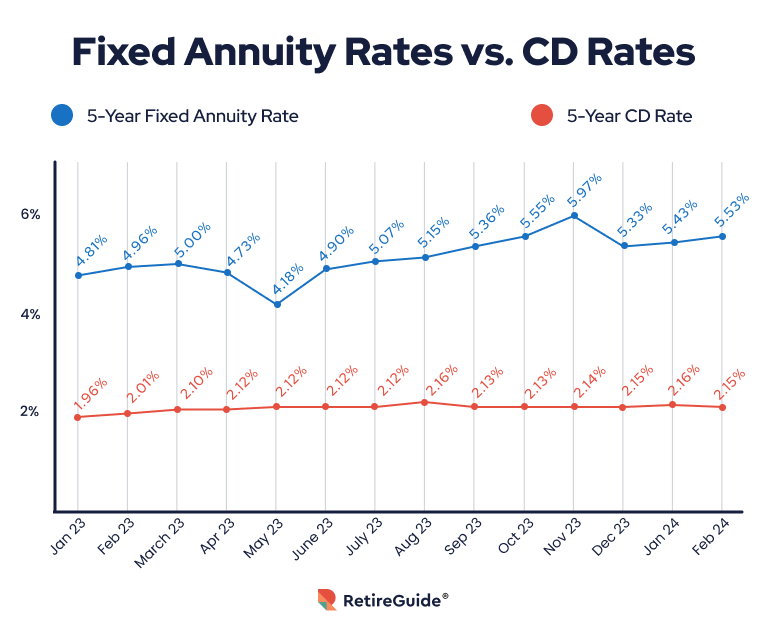

The landscape is moving. As rates of interest decline, dealt with annuities may lose some appeal, while products such as fixed-index annuities and RILAs gain traction. If you remain in the marketplace for an annuity in 2025, store carefully, compare options from the best annuity business and focus on simpleness and openness to locate the right fit for you.

When choosing an annuity, monetary strength rankings issue, but they do not inform the entire tale. Below's exactly how compare based on their rankings: A.M. Ideal: A+ Fitch: A+ Requirement & Poor's: A+ Comdex: A.M. Best: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Best: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A higher financial rating or it only shows an insurance firm's economic toughness.

If you concentrate just on rankings, you may The ideal annuity isn't simply regarding business ratingsit's about. That's why comparing real annuity is a lot more crucial than simply looking at financial toughness scores.

That's why it's important to obtain suggestions from somebody with experience in the industry. is an staffed by independent licensed monetary professionals. We have years of experience assisting people locate the right products for their requirements. And since we're not connected with any kind of business, we can give you unbiased suggestions regarding which annuities or insurance policies are appropriate for you.

We'll assist you arrange via all the alternatives and make the most effective choice for your scenario. When selecting the most effective annuity business to advise to our clients, we employ a detailed approach that, then from there that consists of the following criteria:: AM Ideal is a specific independent ranking firm that reviews insurer.

And bear in mind,. When it comes to fixed annuities, there are lots of options around. And with numerous choices, recognizing which is appropriate for you can be difficult. However there are some things to look for that can assist you limit the area. First, select a highly-rated firm with a strong track record.

Northwestern Mutual Annuity Reviews

Select an annuity that is easy to recognize and has no gimmicks. By following these guidelines, you can be certain you're getting the very best possible bargain on a dealt with annuity.: Oceanview Annuity since they tend to have greater rate of interest with basic liquidity. ("A" rated annuity business): Clear Springtime Annuity since they are straightforward, solid annuity prices and typical liquidity.

Some SPIAs supply emergency liquidity features that we such as.

There are a few key factors when looking for the finest annuity. Compare passion rates. A greater interest rate will provide even more development capacity for your financial investment.

This can quickly enhance your investment, yet it is important to comprehend the terms and conditions attached to the bonus before investing. Lastly, assume regarding whether you want a lifetime earnings stream. This kind of annuity can supply comfort in retired life, yet it is vital to make certain that the revenue stream will be appropriate to cover your demands.

These annuities pay a fixed regular monthly amount for as long as you live. And even if the annuity runs out of cash, the regular monthly settlements will continue originating from the insurer. That implies you can relax simple recognizing you'll always have a steady revenue stream, regardless of just how long you live.

Prudential Annuities Forms

While there are a number of different sorts of annuities, the most effective annuity for long-lasting care prices is one that will certainly spend for a lot of, if not all, of the expenses. There are a few points to consider when picking an annuity, such as the length of the contract and the payout choices.

When choosing a set index annuity, contrast the available items to find one that ideal matches your demands. Athene's Performance Elite Collection American Equity AssetShield Collection Athene Agility Fixed Indexed Annuity is our leading choice for tax deferral for numerous factors. Take pleasure in a life time income you and your partner can not outlive, providing financial safety and security throughout retirement.

Annuity Resources

Additionally, they enable approximately 10% of your account value to be taken out without a penalty on the majority of their product offerings, which is greater than what most other insurer enable. Another variable in our suggestion is that they will enable elders approximately and including age 85, which is likewise more than what a few other business permit.

The very best annuity for retirement will certainly rely on your private requirements and purposes. Nonetheless, some features prevail to all appropriate retirement annuities. Firstly, an appropriate annuity will certainly give a constant stream of income that you can depend on in retirement. It should also offer a safe investment option with potential development without risk.

Convert Life Insurance To Annuity

Ultimately, an ideal annuity should also supply a death benefit Your enjoyed ones are cared for if you pass away. Our recommendation is. They are and constantly supply a few of the highest possible payments on their retired life income annuities. While prices change throughout the year, Integrity and Guarantee are normally near the top and maintain their retired life incomes affordable with the other retired life income annuities in the market.

These scores give consumers an idea of an insurance provider's economic stability and exactly how most likely it is to pay on claims. It's vital to note that these scores do not necessarily reflect the top quality of the products offered by an insurance coverage company. For instance, an "A+"-rated insurance company might use items with little to no development possibility or a reduced revenue permanently.

Besides, your retired life cost savings are most likely to be among the most vital investments you will certainly ever make. That's why we only suggest collaborating with an. These business have a tried and tested track document of success in their claims-paying capability and supply several attributes to aid you satisfy your retirement goals."B" rated business ought to be avoided at practically all expenses. If the insurance company can't achieve an A- or far better rating, you must not "wager" on its proficiency long-lasting. Remarkably, lots of insurer have been around for over 50 years and still can't achieve an A- A.M. Finest ranking. Do you wish to wager cash on them? If you're looking for lifetime income, adhere to assured income motorcyclists and prevent performance-based income cyclists.

Latest Posts

Pv Growing Annuity Formula

Texas Annuity Guarantee Fund

Do I Pay Taxes On An Inherited Annuity